Hourd

Savings tracker & Currency converter

About this app

Ever wondered how much of your life you're trading for that expensive coffee or new gadget? Hourd answers the question that matters most: "How many hours do I need to work for this?"

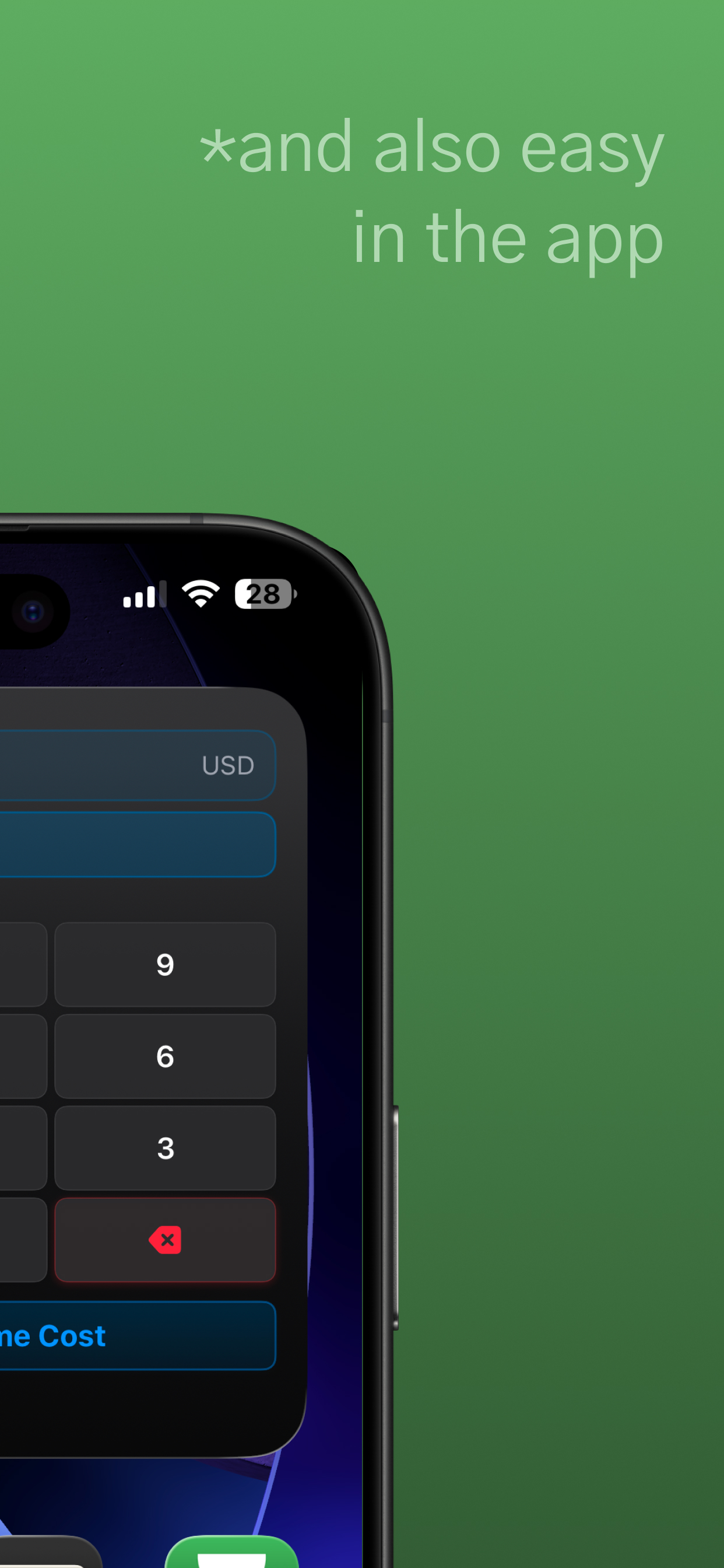

Simple Time Cost Conversion

Type in any price and see exactly how many work hours it represents. Enter your wage hourly, monthly, or yearly, and Hourd will auto‑convert and show you the time cost in hours, days, weeks, months, and years.

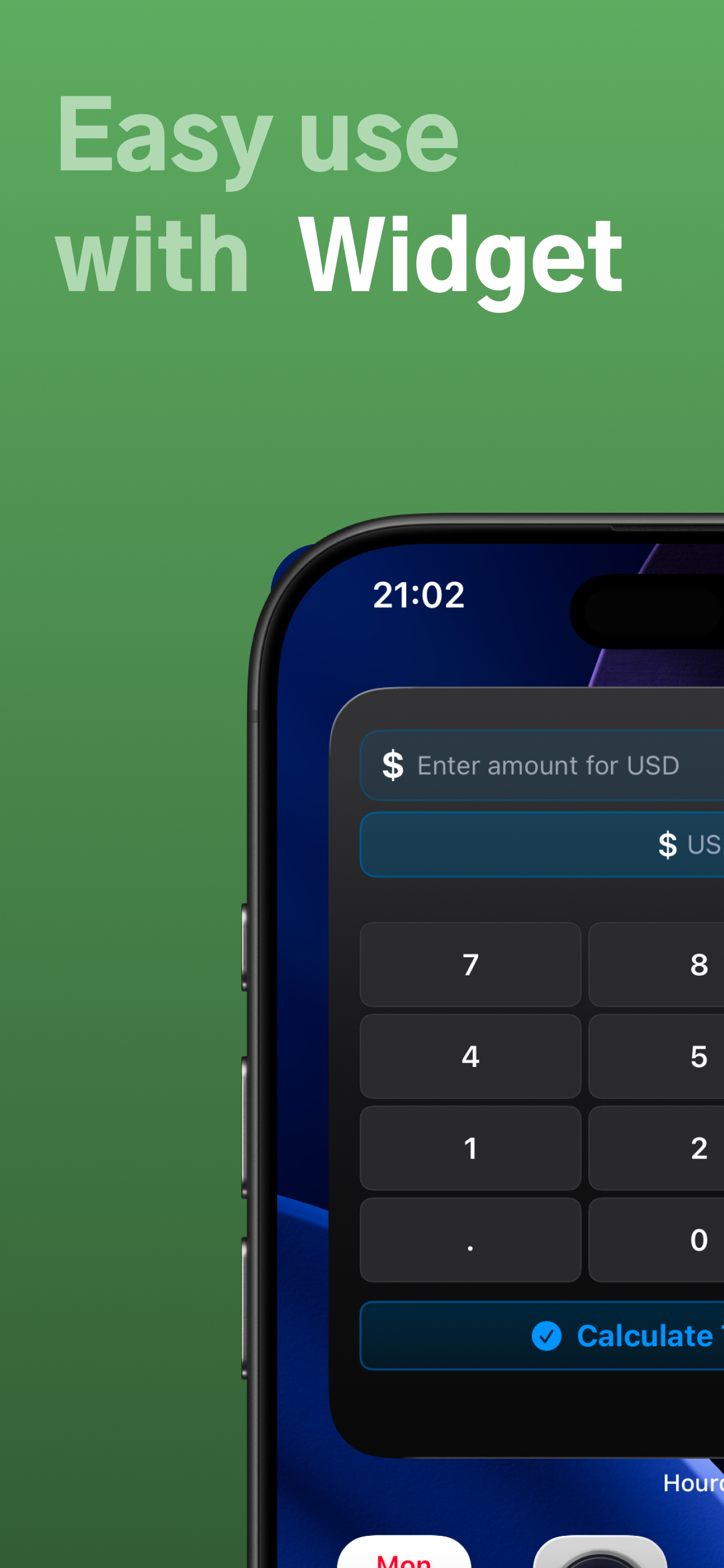

In‑App Calculator + Home Screen Widget

Use the full calculator inside the app or the interactive Home Screen widget for instant calculations. Track "Buy" and "Don't Buy" decisions throughout the day.

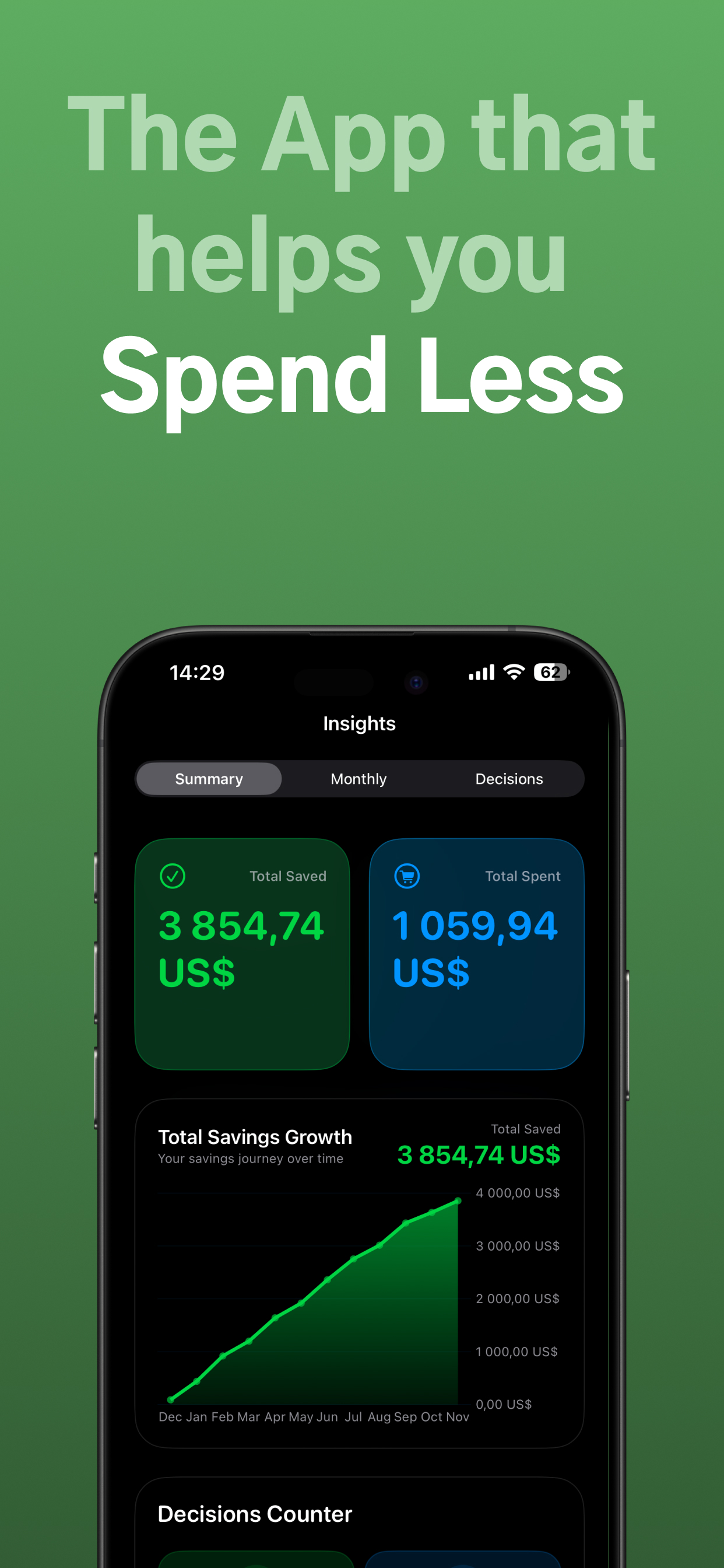

Your Savings Story

See how your smarter decisions add up over time with beautiful charts and insights. Track your progress monthly and watch your savings grow.

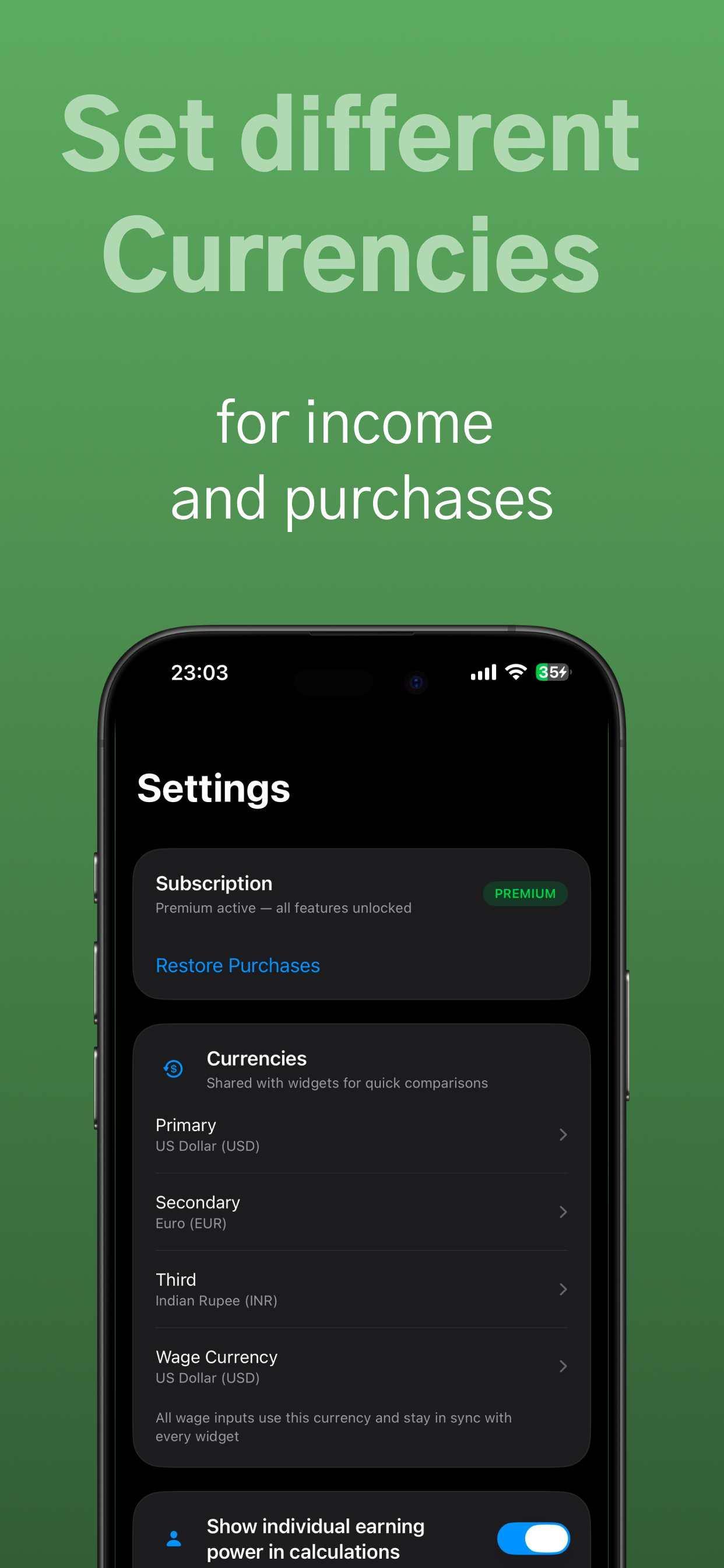

Works Anywhere

Traveling or shopping online? Hourd automatically converts between currencies using current exchange rates.

Why This Approach Works

When you see that a $60 dinner represents 3 hours of work, it changes your perspective. Time feels more real than abstract dollar amounts, making it easier to evaluate whether purchases are truly worth it.